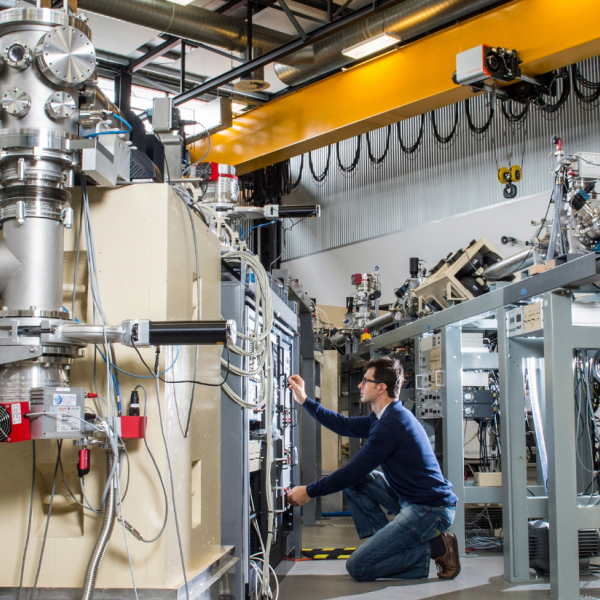

Technology Innovation

Science, technology and innovation power our economy and help create a more sustainable world.

Our expertise in science, research and innovation can provide the key to transferring your ideas from concept to reality.

Connect with usANSTO's commercialisation model brings together multidisciplinary specialists with a wide range of technical, commercial, marketing, corporate finance, management and legal skills to facilitate the application of knowledge and technology developed by ANSTO for a wide range of industry applications.

Protecting Innovation

Innovation is the driving force behind progress and growth. Protecting ANSTO’s intellectual property (IP) through patents ensures our groundbreaking ideas and inventions are safeguarded. ANSTO has patent protected several leading-edge technologies and products.

See our patentsInterested in R&D and partnership opportunities?

Research and development tax incentive

ANSTO is a registered Research Service Provider (RSP), meaning eligible R&D activities can benefit from a tax offset under section 29A of the Industry Research and Development Act 1986. There are two core components to the R&D Tax Incentive:

- A refundable tax offset for certain eligible entities whose aggregate turnover is less than AUD$20 million

- A non-refundable tax offset for all other eligible entities

About registered Research Service Providers

Registered Research Service Providers (RSP) are specialist organisations registered with the Department of Industry, Innovation and Science to undertake research and development on behalf of, or under contract to other companies. When you work with a registered RSP organisation, you can be assured of the quality of the skills and resources being offered.

In addition, as ANSTO is an RSP, all eligible research and development expenses can be claimed, subject to certain criteria through the R&D Tax Incentive.

ANSTO's registration number is 12657.